Key Takeaways

- Bitcoin’s price fell below $87,000, leading to a sharp market decline.

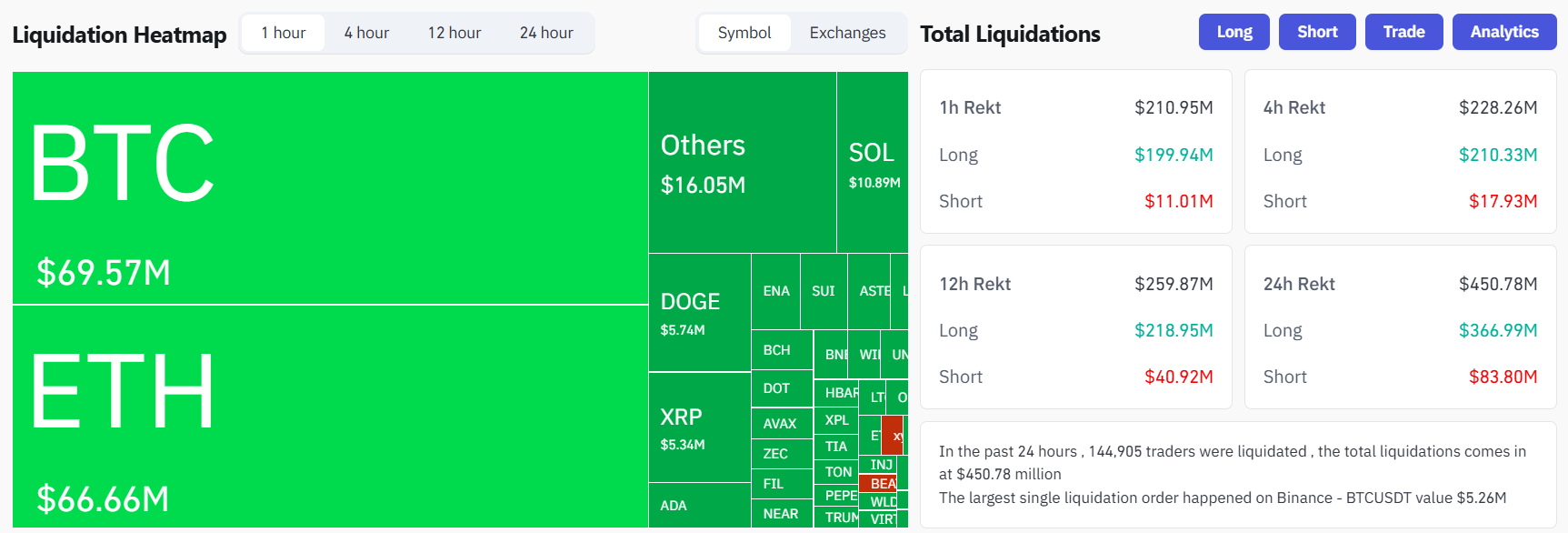

- Nearly $200 million in long positions were liquidated within one hour.

Share this article

Bitcoin’s price suddenly dropped below $87,000 on Monday, wiping out nearly $200 million in long trades in the last hour, according to data from CoinGecko and Coinglass.

Long liquidations occur when exchanges automatically close leveraged long positions after prices fall below certain thresholds, requiring traders to sell their holdings.

The pullback in Bitcoin sent shockwaves across the crypto market. Ethereum, BNB, and Solana each lost around 4% in the last hour, while XRP fell nearly 3%.