Key Takeaways

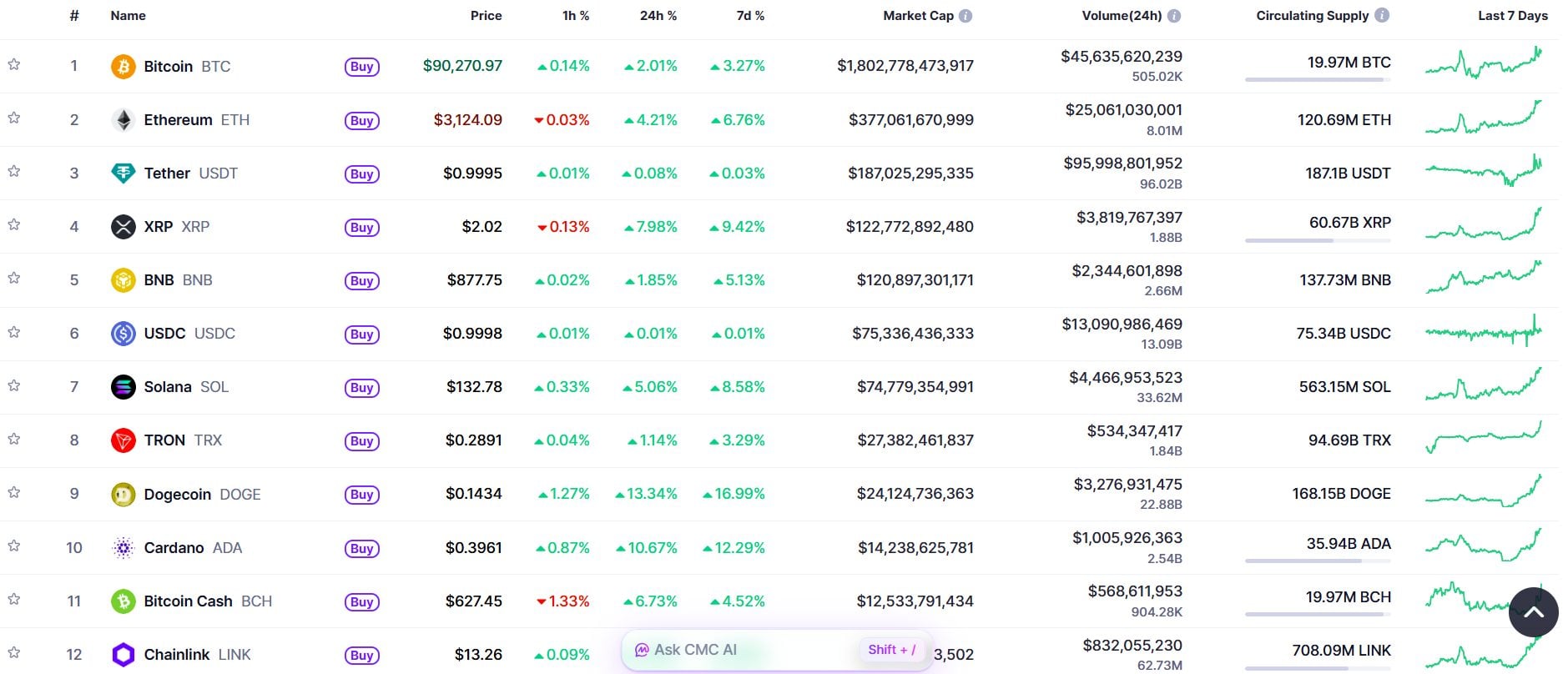

- Bitcoin surged past $91,000, hitting its highest value since December 12.

- The rally in Bitcoin influenced the broader crypto market, with other cryptocurrencies like Ether, XRP, BNB, and Solana also posting gains.

Share this article

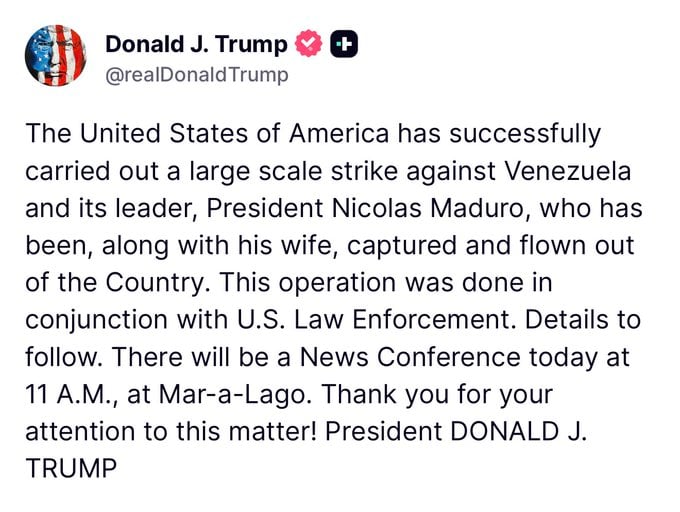

Bitcoin has climbed back above $91,000 to the surprise of many who expected a deeper pullback following the US military intervention in Venezuela and Trump’s Saturday address on the situation.

The leading crypto asset is trading at $91,346, per CoinGecko, after bouncing back to $90,000 on Friday and holding steady through Saturday despite geopolitical volatility. It is now at its highest level since December 12.

Altcoins joined the rally, with Ethereum, XRP, BNB, and Solana all posting gains. In the last 24 hours, the total crypto market cap rose 1% to $3.2 trillion. MYX Finance, TRON, and Dogecoin were standout performers during this stretch.

Trump told reporters on Saturday that the US would oversee Venezuela until a secure transition of power is possible, following his claim that Venezuelan leader Nicolás Maduro and his wife had been captured.

Maduro is being held in New York and faces a court appearance on narco-terrorism charges on Monday, according to the BBC.

The crypto market is the only active venue for price discovery this weekend. But the biggest market reaction is expected in oil, where traders may begin to factor in higher geopolitical risk. Any disruptions to Venezuelan exports or fears of regional instability could support crude prices in the short term, even if there is no immediate supply shock.

Trump’s strategy focuses on deploying US oil majors to fix the country’s dilapidated energy infrastructure, promising a lucrative return for both nations.

Commenting on Trump’s plans, Russian billionaire Oleg Deripaska said gaining control of Venezuela’s oil fields could give the US effective influence over more than 50% of global reserves.

Venezuela’s deposits are estimated at around 303 billion barrels, the largest globally and equal to roughly one-fifth of proven world reserves.