Key Takeaways

- Bitcoin surged to $88,500 following a period of fear when prices dipped to $78,000.

- Arthur Hayes projects Bitcoin will exceed $110,000 due to anticipated US Fed policy shifts.

Share this article

Bitcoin’s resurgence to $88,500 has reignited optimism among retail traders, but blockchain analysis firm Santiment’s analysis of social media predictions suggests caution.

In late February and early March, Bitcoin faced major pressure, with prices dropping to $78,000 twice. The decline was driven by several factors, including President Trump’s economic policies and tariffs, as well as macroeconomic factors.

Concerns about inflation and potential tighter monetary policies by the Fed contributed to risk-off sentiment, making Bitcoin and altcoins less appealing compared to safer assets.

During the same period, gold prices reached new highs, touching $3,057 in March 2025 after hitting $2,956 per ounce in February.

The price decline led to widespread fear among traders and investors. However, the second half of March brought a sharp reversal, with Bitcoin rebounding to $88,500.

The recent price recovery has shifted market sentiment toward mild greed, according to Santiment.

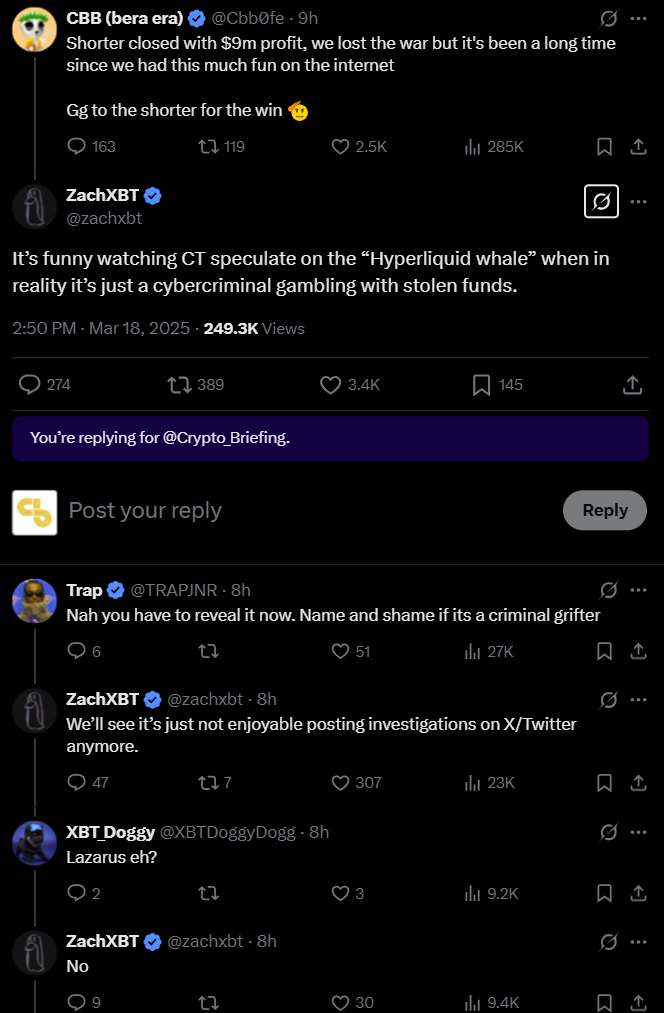

Santiment’s social media analysis shows traders are making bullish price predictions ranging from $100,000 to $159,000 for Bitcoin, while bearish forecasts span $10,000 to $69,000.

Santiment warns that crowd sentiment often signals the opposite of what actually happens next.

History suggests that when the majority of social media users predict soaring prices, the market is more likely to experience a downturn, the firm states. Conversely, when pessimism dominates and predictions turn bleak, prices tend to recover.

Santiment suggests caution during periods of extreme market sentiment. When social media is flooded with posts declaring “to the moon” or “lambo time,” it may be a warning sign of an impending correction.

“When you see “crypto is dead” or “bitcoin is a scam”, this should be music to your ears,” the firm noted.

Bitcoin traded at around $87,200 at press time, showing a 6% gain over the past week, according to CoinGecko data.

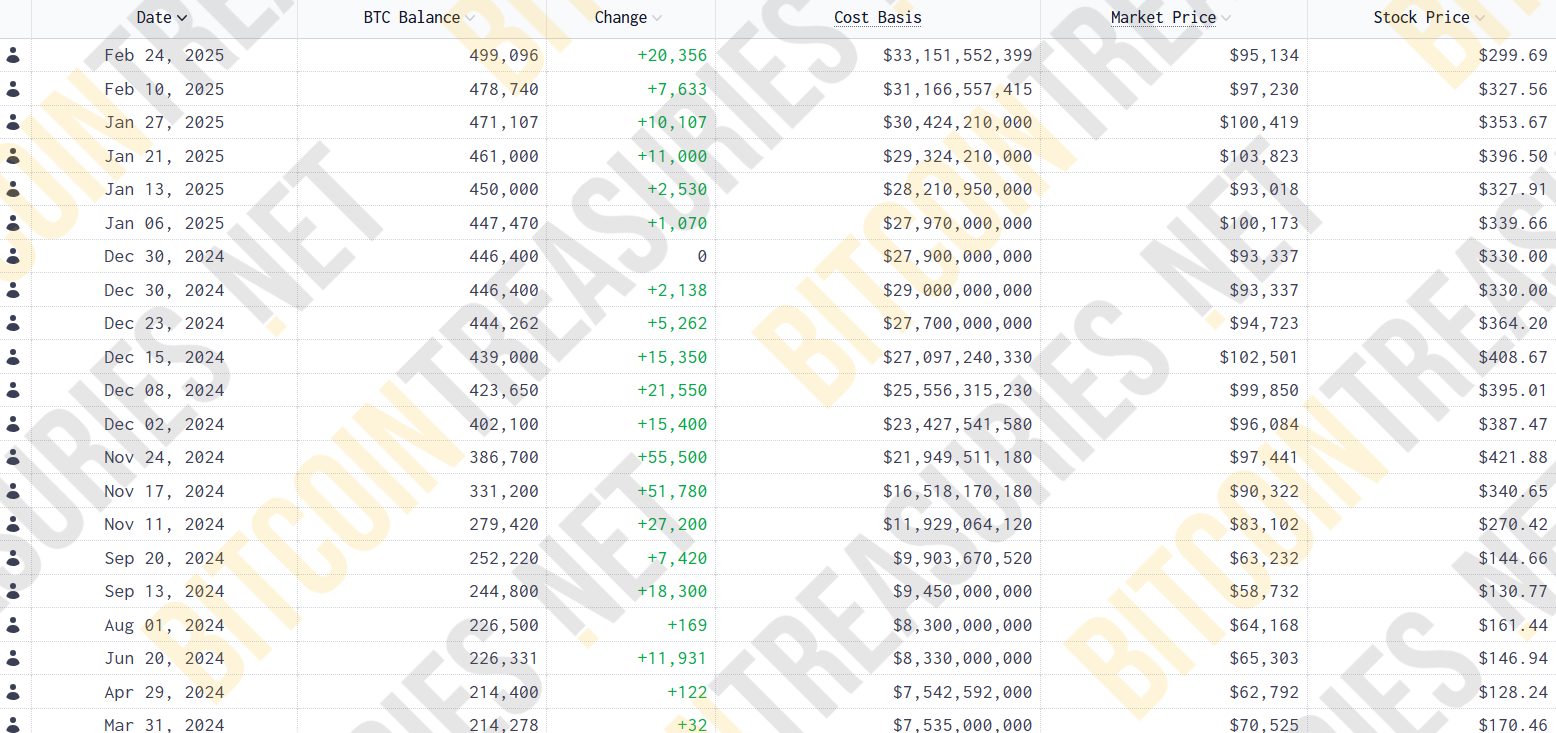

Arthur Hayes, co-founder of BitMEX, forecasts Bitcoin will surpass $110,000, propelled by the US Fed transitioning from quantitative tightening to easing. This shift may inject liquidity into the market, bolstering the price of Bitcoin.

Markus Thielen, 10X Research founder, suggests that while easing measures and relaxed tariff discussions could support Bitcoin’s recovery, immediate catalysts for a dramatic surge appear limited.

Share this article