Key Takeaways

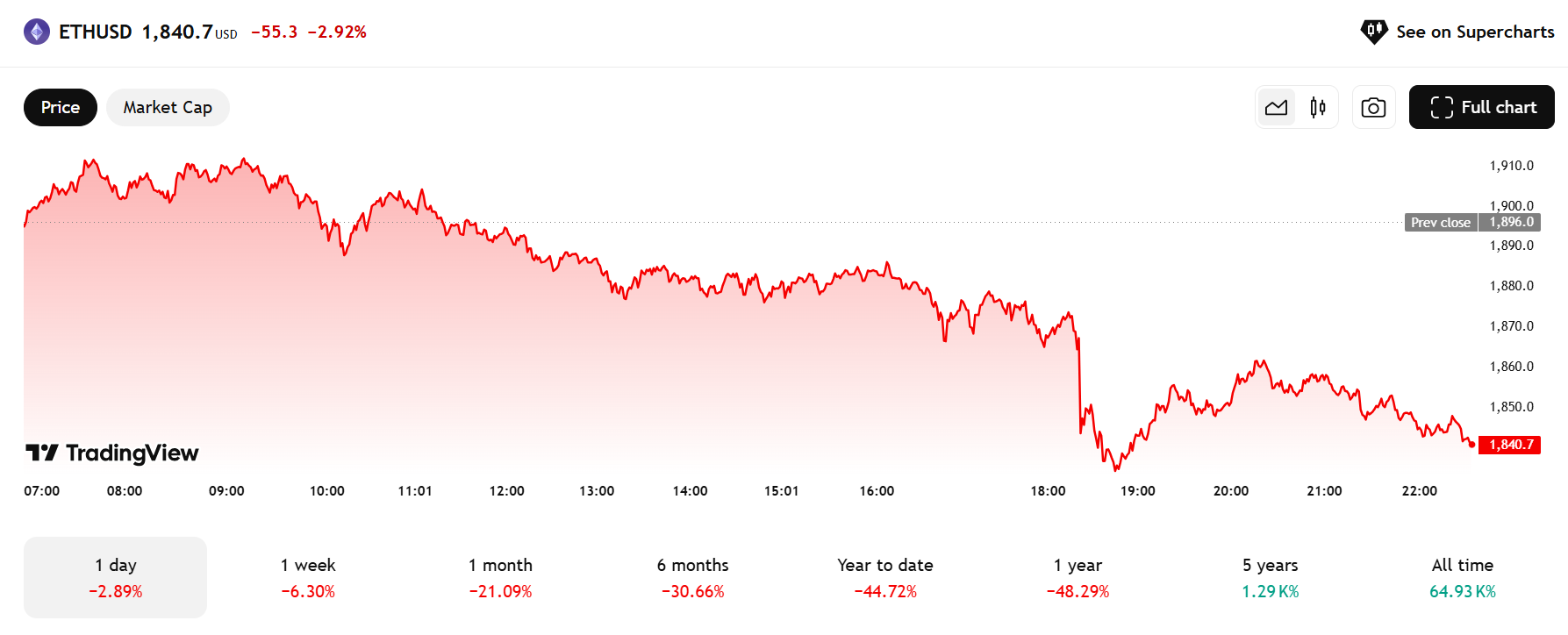

- Multiple altcoins experienced sudden price declines on Binance, including a 50% drop for ACT.

- Binance’s position limit adjustments might have contributed to the market volatility and forced liquidations.

Share this article

Several altcoins experienced sharp price drops on Binance on Tuesday, with Act I: The AI Prophecy (ACT) plunging 50% from $0.18 to $0.083 within minutes.

DeXe (DEXE) fell 38% to $11, while dForce (DF) declined 19% to $0.06.

Other affected tokens include Bananas For Scale (BANANAS31), LUMIA (LUMIA), QuickSwap (QUICK), and 1000CHEEMS.

The recent sharp drops in these altcoins are still unexplained. Community speculation has pointed towards Wintermute as a possible factor.

Everyone talking about the Wintermute situation, and no, it’s not an April fools joke.

Lots of theories out there, but @danielesesta 👏 explanation seems the most logical:

Wintermute was working with USD1 ( a stablecoin by World Liberty Financial). Since this is a major deal,… pic.twitter.com/NRwpbXB38z

— is_a_force (@OnyshchukInvest) April 1, 2025

This isn’t an April 1 joke.

Wintermute is pouring assets off their balance sheet where they were acting as MM. Either their wallets have been hacked, or – I have no other explanation yet.

Some very strange things are happening. ACT folded 2x in minutes, +-10 assets are… pic.twitter.com/Bqc3Hhl8KS

— Depression (@0xDepressionn) April 1, 2025

However, Wintermute CEO Evgeny Gaevoy has refuted these claims, adding that he, too, is curious about the cause of the downturn.

Not us fwiw, but also curious about that post mortem😅

— wishfulcynic (@EvgenyGaevoy) April 1, 2025

Wintermute was recently involved in test transactions related to USD1, a stablecoin launched by World Liberty Financial (WLFI) and backed by the Trump family.

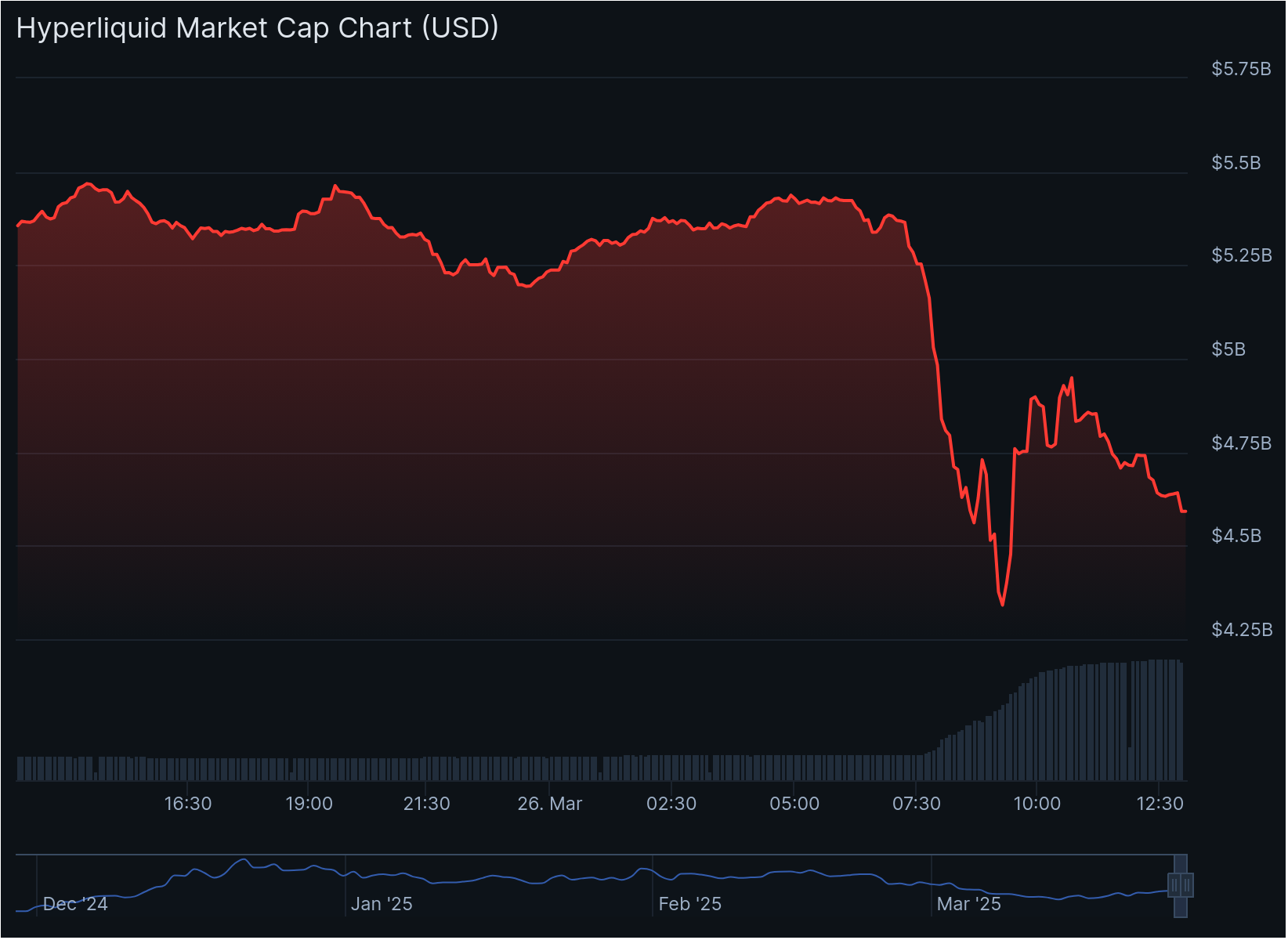

Market observers suggest the drops might be linked to Binance’s recent position limit adjustments.

The changes require traders to maintain higher margin levels for the same position sizes. For instance, positions that previously required $1 million in margin to hold a $5 million position now need additional margin to avoid automatic liquidation.

Some speculate that market makers may have failed to meet the new margin requirements, leading to forced liquidations in low-liquidity markets.

Share this article