Dubai, UAE, December 16th, 2025, Chainwire

YEX , a fast-growing cryptocurrency exchange committed to making trading simple and accessible for everyone, announced the launch of its Christmas Futures Trading Championship – Holiday Season 2025, a themed series of its futures trading competitions aimed at engaging crypto traders worldwide. The campaign offers a total prize pool of $21,000 in real USDT and DOGE rewards.

The championship is now open and will run until December 31, 2025, inviting both experienced futures traders and beginners to participate. As it says, all participants can enjoy clear rules, transparent rankings, and guaranteed rewards for eligible tradings.

Campaign Details and Prizes

The Christmas Futures Trading Championship ranks participants based on individual futures trading performance. All prizes will be credited directly to participants’ YEX accounts in real-time.

Prize Distribution

- 1st place: 5,000 USDT

- 2nd place: 3,000 USDT

- 3rd place: 1,000 USDT

- 4th–100th place: Share of $10,000 worth of DOGE token

Additionally, eligible participants may receive a share of a $2,000 futures bonus distributed at random, allowing both high-performing and casual traders to take part in the event. This structure is intended to support broader engagement, including among less experienced users, by providing an opportunity to explore futures trading with limited initial exposure.

The competition is accessible on both PC and mobile platforms:

Futures-A Featured Product of YEX Exchange

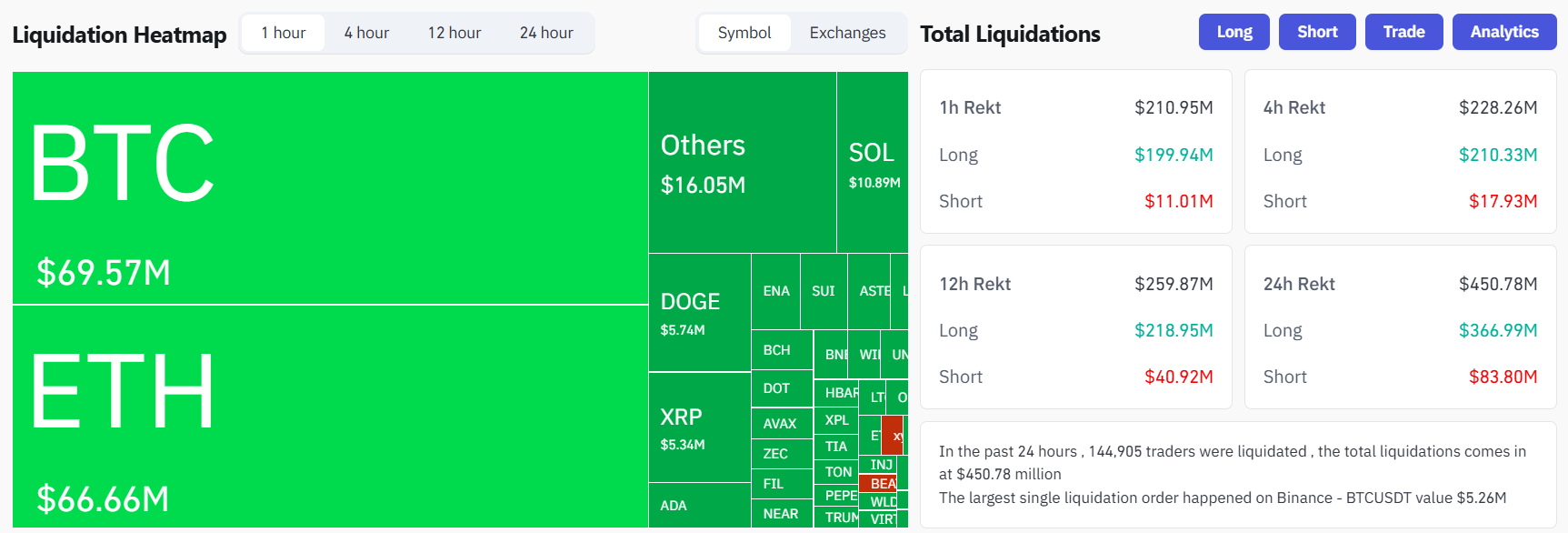

YEX Futures offers cryptocurrency derivative trading with over 200 listed trading pairs. Traders can buy and sell perpetual futures contracts to speculate on price movements, and these contracts have no expiration date, allowing continuous trading at agreed-upon prices. This flexibility distinguishes YEX Futures from traditional futures, giving traders more control over their positions.

The platform supports leverage up to 150X, one of the highest in the market, allowing traders to amplify their potential gains while carefully managing associated risks. YEX also provides futures copy trading features, enabling users to follow professional traders, observe strategies in real time, and automatically copy their trades. This functionality is particularly valuable for beginners, offering an opportunity to learn market strategies and potentially replicate the success of experienced traders while minimizing learning curves.

Beyond futures trading, YEX’s ecosystem also includes spot trading, margin trading, staking, AI-powered trading bots, and institutional tools. These features collectively create a comprehensive trading environment where users can explore diverse crypto financial instruments and manage their portfolios efficiently.

About YEX

YEX is a fast-growing crypto exchange dedicated to making trading simple and accessible for everyone. Aiming to “Make Trading Easy”, YEX put users at the center of its operations, combining intuitive offerings and robust security to create a trustworthy platform.

With a comprehensive suite of crypto products, including derivatives, spot, margin trading, staking, AI bots, copy trading, and institutional tools, YEX is committed to empowering the next billion crypto users to explore and unleash their potential in crypto finance. The platform is also available on iOS and Android, providing users with the convenience to participate in crypto finance with ease.

Headquartered in Dubai and trusted by users worldwide, YEX is built on the principles of simplicity, security, and user-centricity, helping everyone trade confidently and exploring new opportunities in crypto.

Users can learn more about YEX:

Website: https://yex.io

X: https://x.com/YEXOfficial_EN

Telegram Community: https://t.me/YEXOfficial_EN

Contact

PR Manager

Amelia

YEX Exchange

[email protected]