Key Takeaways

- Bitcoin has gained over $10K since the start of 2026, fueling a broad rally across crypto markets and driving Polymarket odds of a $100K BTC in January to 72%.

- Over $780M in liquidations hit the market in the last 24 hours, mostly from short positions on BTC and ETH, as traders bet on further upside.

Share this article

Bitcoin surged to a new eight-week high on Wednesday, crossing $97,300 amid renewed momentum across the crypto market. The rally continues a strong start to 2026, with Bitcoin gaining over $10,000 since opening the year near $87,000.

Traders appear to be positioning for further upside, with Polymarket odds now assigning a 72% chance of Bitcoin reaching $100,000 before the end of January.

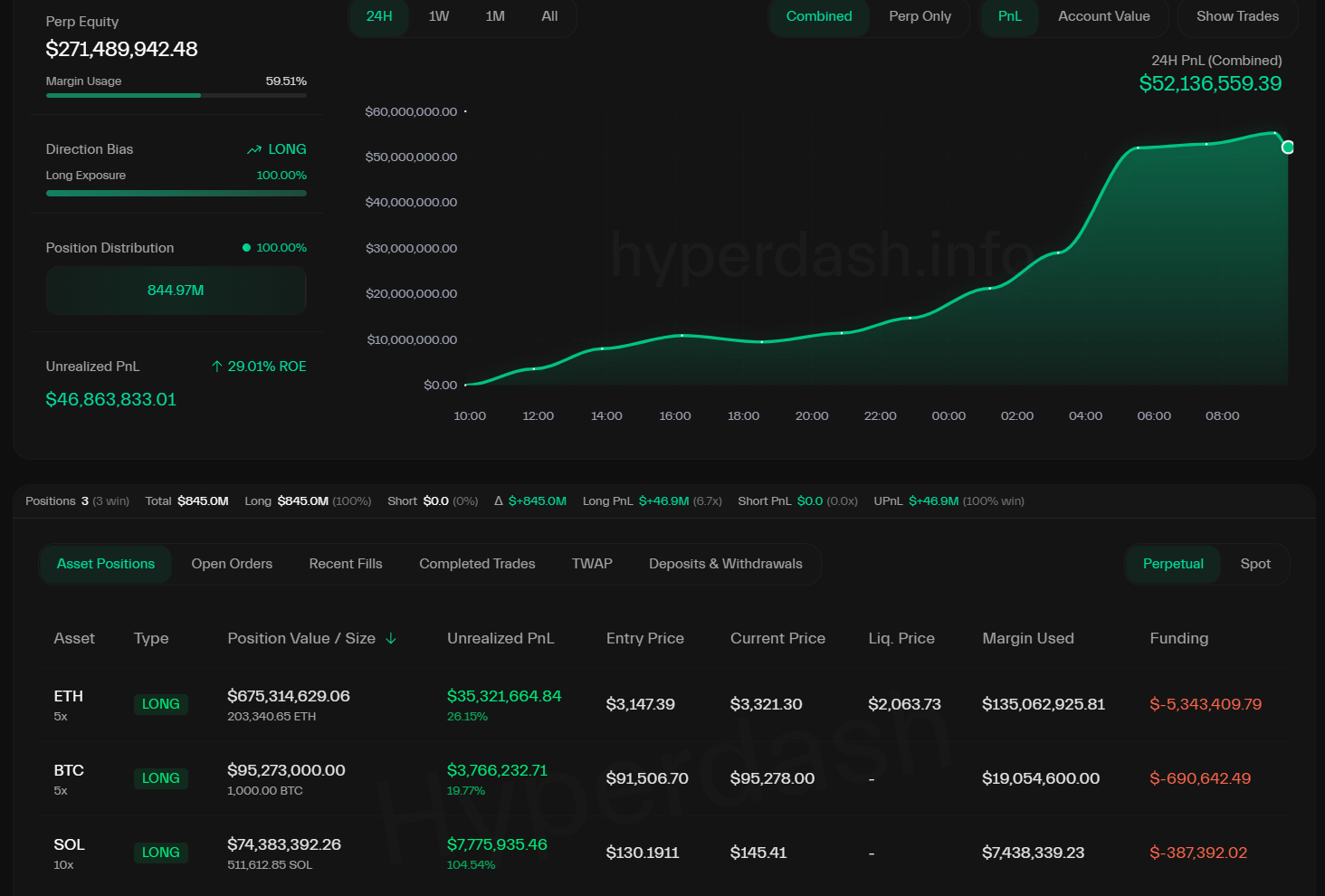

The rally lifted the broader crypto market by over 4% in the past 24 hours, pushing total market capitalization to $3.34 trillion. Ethereum climbed near $3,400, Solana hit $148, and XRP reached $2.17, reflecting broad-based strength among major assets.

In the past 24 hours, crypto markets saw $783 million in liquidations, driven by Bitcoin’s rally. CoinGlass data shows $682 million in shorts and $101 million in longs were wiped out, with most of the impact concentrated in BTC and ETH futures.