Key Takeaways

- European carmaker shares slide as Trump tariff threat tied to Greenland dispute weighs on auto stocks.

- EU signals up to €93 billion in retaliatory tariffs if US proceeds with planned levies.

Share this article

Shares of Europe’s largest carmakers fell sharply today after US President Donald Trump pledged to impose new tariffs on several European countries amid a dispute over Greenland.

The Stoxx Automobiles and Parts index was trading about 2% lower on Monday at 2 pm ET after paring steeper losses earlier in the session.

Germany’s Volkswagen, BMW, and Mercedes-Benz Group were down between 2.5% and 3%. Shares of Porsche fell more than 3%.

In Milan, Ferrari slipped about 2.2%, touching a 52-week low, while Stellantis was last seen around 1.8% lower.

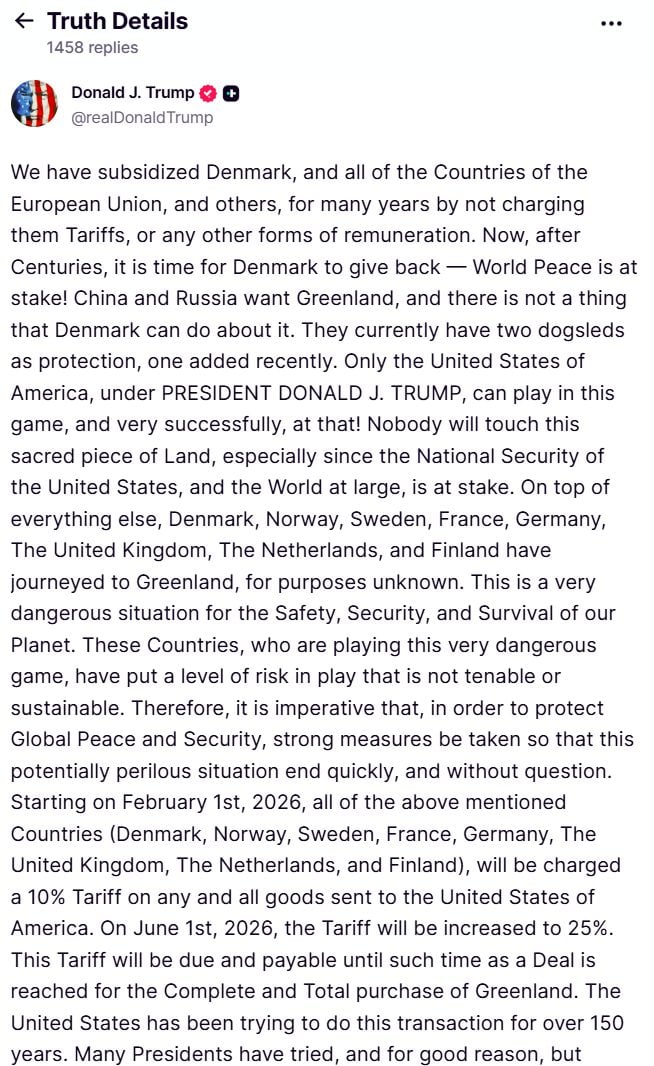

The selloff followed Trump’s announcement that the US plans to impose a 10% tariff on imports from the UK, Denmark, Norway, Sweden, France, Germany, the Netherlands, and Finland starting February 1.

Trump said the levy would rise to 25% from June 1. The move is tied to his renewed push to bring Greenland, a self-governing Danish territory, under US control.

In response, European leaders said early Monday the European Union is preparing up to €93 billion in retaliatory tariffs if the US moves ahead with the 10% levy on European countries.

The automotive sector is viewed as particularly vulnerable due to its highly globalized supply chains and heavy reliance on cross-border manufacturing, including significant exposure to North America.